Taxation Books

Taxation Books

Refine Search

Bloomsbury's GST Tariff 2020 by CA. Bhavesh Gupta

Contents:Part A: GST Tariff - Goods (HSN Code-wise) Part B: GST Tariff - Services (Service code-wise..

Rs1,995.00

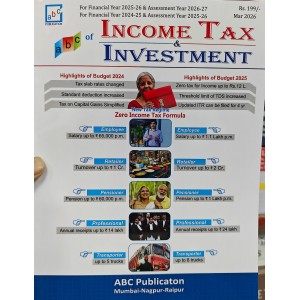

ABC Publication's ABC of Income Tax and Investment 2025 by CA. A. N. Agrawal

Please Note: Price of the book is Rs. 199 + includes Delivery Charge Rs. 65.ABC of In..

Rs264.00

Adv. U. P. Deopujari's Law Relating to Trusts & Temples in Maharashtra [HB] by Nagpur Law House

Law Relating to Trusts & Temples in Maharashtra With Central Statutes, Short Notes, Rules, No..

Rs950.00

Ajit Prakashan's All About the Goods & Service Tax Act, 2017 (GST)

Please Note: Price of the book includes Delivery Charge Rs. 60. ..

Rs535.00

Ajit Prakashan's Goods & Service Tax Act Introduction [GST] [Marathi] by Adv. Sudhir J. Birje

Please Note: Price of the book includes Delivery Charge Rs. 65...

Rs310.00

Ajit Prakashan's Manual On Infrastructure by Directorate of Infrastructure CBDT - Revenue Dept. Ministry of Finance Govt. of India

Please Note: Price of the book includes Delivery Charge Rs. 60...

Rs685.00

Ajit Prakashan's The Income Tax Act, 1961 & The Income Tax Rules, 1962 (Pocket 2022-23)

Please Note: Price of the book includes Delivery Charge Rs. 60...

Rs205.00

Amar Law Publication's Master Key Law of Export Import Regulation by Ankita Pal

Import & Export are two Important Components of Foreign trade which is nothing but exchange o..

Rs280.00

Asia Law House's GST Rate Finder on Goods by Ghanshyam Upadhyay [Edition 2021]

Ready Reckoner for: 1. GST Rate on Goods Alphabetically as per Notifications, Circulars, Finance A..

Rs1,260.00

BDP's Business Guide to Free Trade Agreements (FTA) compiled by Ajay Srivastava

This book is about making good use of Free Trade Agreements(FTA's) signed by India.It concern wit..

Rs1,095.00

BDP's Central Excise Tariff Edited by Anand Garg

* Easy Reference * Budget Highlights * Product Index * Each item with CENVA..

Rs1,395.00

BDP's Country Wise Import Duty Ready Reckoner 2023 by Ajay Srivastava

This book is about making good use of Free Trade Agreements (FTAs) for enhancing business profits. T..

Rs2,995.00

BDP's Foreign Trade Policy with Handbook of Procedures 2023 (FTP) by Anand Garg

This book contains the Government of India's new FTP: Foreign Trade Policy with ..

Rs2,095.00

BDP's GST Manual & Law Guide with Commentary by Dr. Somesh Chander

Incorporating : Chapter covering GST Topics based in CGST Act and CGST Rules..

Rs1,595.00

BDP's GST Notifications

Incorporating :GST Central Tax / Central Tax Rate NotificationsIntegrated Tax / Integrated Tax Rate ..

Rs595.00

BDP's GST Tariff by Dr. Somesh Chander & Anand Garg [2018-19]

The Only Book Which Gives Each Item With 8-digit Hsn Code, Central/ State/ Ut Tax,..

Rs1,795.00

BDP's ITC-HS Classifications on Import Items with Indian Import Tariff by Anand Garg [2 Vols. Edn. 2023]

The only book which gives all the Duties and Foreign Trade Policy at a Glance. Basic Duty, Effective..

Rs3,795.00

BDP's Standard Input-Output Norms [Vol.2] by Anand Garg

This book contains the Government of India's Input-output Norms as be the New Foreign Trade Polic..

Rs1,595.00

BDP's The GST Nation : A Guide for Business Transformation by Ajay Srivastava

The GST Nation Covers :How GST works : Learn through simple examples.GST Strategy for Business Trans..

Rs795.00

Bharat ABC of GST by Anil Goyal, Pranjal Goyal & Vaishali Goyal [Edn. 2023]

This 1st edition, published in 2023 with ISBN 9789394163706, provides valuable insigh..

Rs995.00

Bharat Law House's Minimum Alternate Tax (MAT) by CA. Kamal Garg [Edn. 2023]

ContentsChapter 1 Minimum Alternate Tax (MAT) — An Introduc..

Rs1,195.00

Bharat Law House's Tax Audit & E-filing 2022 by CA. Kamal Garg

CONTENTS Chapter 1 Tax Audit under section 44AB of the Income Tax Act, 1961..

Rs2,295.00

Bharat Law Publication's Tax Planning Issues Ideas Innovations [HB] by S. Rajaratnam & V. G. Arvindanayagi [2021 Edn.]

Contents:1 Tax Planning-An overview 2 Interpretation of Tax Laws : 3 Importance of Documentation i..

Rs3,495.00

Bharat's A Practical Approach to Taxation & Accounting of Charitable Trusts, NGOs & NPOs 2023 by CA. N. Suresh

DIVISION IRole of NGOs and NPOsChapter 1 Significant Role o..

Rs2,995.00

Bharat's Capital Gains (Law & Practice) by CA. Divakar Vijayasarathy

Contents:Chapter 1 Basics of Capital Gains Chapter 2 ..

Rs1,695.00

Bharat's Compendium of Issues & Solutions in GST by CA. Madhukar N. Hiregange, Adv. K. S. Naveen Kumar

Content:Part A Chapter 1 Background of Goods and Services TaxCha..

Rs2,295.00

Bharat's Direct Taxes Manual 2023 [DT 3 HB Volumes]

Volume 11. Income-tax Act, 1961Text of sectionsChronological list of Amendment ActsSUBJECT INDEXAppe..

Rs7,295.00

Bharat's Direct Taxes Ready Reckoner 2023 with Tax Planning & FREE ebook access by Mahendra B. Gabhawala | DT Reckoner

Contents:Chapter 1 Significant Amendments made by Finance B..

Rs1,895.00

Bharat's E-Invoice under GST by CA. J.P. Saraf

Contents:Chapter 1 Introduction to E-Invoice SystemChapter 2&nbs..

Rs750.00

Bharat's Faceless Assessments, Rectifications & E-Advance Rulings by R. P. Garg, Sunita Garg

Contents:1. New Faceless Assessment Chart2. &nbs..

Rs1,495.00

Bharat's Forensic Audit by CA. Kamal Garg

Auditing — Nature and Basic ConceptsPreparation for an AuditInternal ControlEDP AuditInvestigations,..

Rs495.00

Bharat's GST Law & Procedures by CA. Ashok Batra [3 Vols. 2023]

About G S T (Law & Procedure) Volume 1Division 1ReferencerReferencer 1 ..

Rs7,195.00

Bharat's GST on Real Estate & Works Contracts by Adv. Ramesh Chandra Jena

Contents:PART I: Basics of GSTChapter 1 Background of G..

Rs995.00

Bharat's GST Ready Reckoner 2023 by CA. Ashok Batra

ReferencerGST Compliance Calendar for February, 2023 to March, 2024Referencer 1 &nb..

Rs2,595.00

Bharat's GST Smart Guide by Ramesh Chandra Jena

ContentsChapter 1 GST — Concept & StatusChapter 2 Constitutional AmendmentChapter 3 Levy and Col..

Rs2,095.00

Bharat's Guide to GST Litigation & Proceedings [HB] by Preetam Singh

ContentsThe Constitutional AmendmentThe LegislationGoods and Services Tax PractitionerAdministration..

Rs1,495.00

Bharat's Guide to International Taxation by CA. Kamal Garg

Contents: Residence and Scope of Total IncomeSpecial Provisions Relating to Foreign Company Sai..

Rs1,695.00

Bharat's Guide to Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 [SVLDRS] by CA. Pritam Mahure

Guide to Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019withService Tax ProvisionsCenvat Cred..

Rs395.00

Bharat's Handbook on GST (Goods & Service Tax) for CA / CS / CMA / BBA / Bcom / Mcom Inter May 2024 Exam [New Syllabus] by Raj K. Agrawal

Contents:Chapter 1 Concept of Indirect Taxes &..

Rs475.00

Bharat's Handbook to Direct Taxes 2023 by Bomi F. Daruwala & CA. Prerna Peshori

Contents:DIVISION 1: AMENDMENTS AT A GLANCE Chapter 1Direct Tax Amendments made by the Finance Act,..

Rs1,895.00

Bharat's Handbook to Income Tax Rules 2023 by CA. Madhusudan Agarwal

Covering:Division 1 Checklists & Tables1 Prescribed Authorities under the Income Tax Rules/Act2 ..

Rs1,995.00

Bharat's How to handle GST Audit with real life case studies by CA. Arun Chhajer, Md. Samar, Adv. Nitin Sharma

About How to handle GST Audit with real life case studies Chapter 1 ..

Rs695.00

Bharat's Income Tax Act 2023 with Departmental Views

About Income Tax Act with Departmental Views1. Income-tax Act, 1961Text of sectionsChronological lis..

Rs2,395.00

Bharat's Income Tax Rules with Return Forms 2023 [Free E-Book Access]

DIVISION ONEINCOME TAX & ALLIED RULES1. The Income-tax Rules, 1962 Chronological list of amendm..

Rs2,395.00

Bharat's Manufacturing in Customs Bonded Warehouse by Raveendra Pethe, CA Amrendra Chaudhri, CS, LLB Sunil Kumar Rajesh Ingale

HIGHLIGHTS OF THE BOOKThe book covers discussion on the legal provisions regarding manufacturing in ..

Rs1,495.00

Save6%

Bharat's Practical Guide to Ind-AS & IFRS 2024 Edition by CA. Kamal Garg

DIVISION IChapter 1 IFRS and Ind AS: An O..

Rs3,295.00 Rs3,495.00

Bharat's Taxation Regime for ONLINE GAMING by by CA. R. S. Kalra [Edn. 2023]

Contents: Chapter 1 Introduction Chapter 2 Legal Position of Online Fantasy Sports Gaming in In..

Rs395.00

Bharat's Treatise on Schedule III (A guide for preparation of Financial Statements F. Y. 2022-23) by CA. (Dr.) Alok K. Garg [Edn. 2023]

Contents: Chapter 1 Schedule III of the Companies Act 2013 –..

Rs1,195.00

Bharat’s A 360° Approach to Presumptive Taxation by CA. R. S. Kalra

ContentsChapter 1 IntroductionChapter 2 Provisions of Section 44ABChapter 3 Concept & Meaning of..

Rs495.00

Bharat’s All About Trusts & NGOs by CA. Chunauti H. Dholakia [Edn. 2023]

ContentsChapter 1 IntroductionChapter 2 &n..

Rs1,595.00

Bharat’s Handbook on Internal Auditing by CA. Kamal Garg

Contents:Chapter 1 Auditing — Nature and Basic Concep..

Rs1,695.00

Bharat’s Handbook on Tax Deduction At Source [TDS] Including Tax Collection At Source [TCS] 2023 by CA. P.T. Joy

Tax Deduction at Source or TDS, as it is popularly called, is as tedious as its acronym. The intrica..

Rs695.00

Bharat’s Interest, Fee & Penalty by R. P. Garg [Edn. 2023]

Contents:Chart 1 Interest &am..

Rs1,195.00

Bharat’s Practical Guide to GST on Automobile Industry by CA Madhukar N. Hiregange, CA. Vikram Katariya, CA. Shilpi Jain, CA. Pradeep V. | Taxsutra

Key HighlightsDetailed and practical analysis of GST provisions which directly impact the automobile..

Rs1,495.00

Bharat’s Reverse Charge Mechanism under GST (RCM) by CA. Satbir Singh [Edn. 2023]

Contents:Part IChapter 1 RCM under GST: Past to PresentChap..

Rs1,095.00

![Adv. U. P. Deopujari's Law Relating to Trusts & Temples in Maharashtra [HB] by Nagpur Law House Adv. U. P. Deopujari's Law Relating to Trusts & Temples in Maharashtra [HB] by Nagpur Law House](https://law-all.com/image/cache/catalog/data/Book Images/Nagpur Law House/2020/NLP028-300x300.JPG)

![AIFTP's GAAR General Anti-Avoidance Rules [HB] by All India Federation of Tax Practitioners AIFTP's GAAR General Anti-Avoidance Rules [HB] by All India Federation of Tax Practitioners](https://law-all.com/image/cache/catalog/data/Book Images/All India Federation of Tax Practitioners/2020/AIFTP01-300x300.jpg)

![Ajit Prakashan's Goods & Service Tax Act Introduction [GST] [Marathi] by Adv. Sudhir J. Birje Ajit Prakashan's Goods & Service Tax Act Introduction [GST] [Marathi] by Adv. Sudhir J. Birje](https://law-all.com/image/cache/catalog/data/Book Images/Ajit Prakashan/2021/AP015-300x300.jpg)

![Ajit Prakashan's Indirect Taxes Laws [Pocket-IDT] 2022-23 Ajit Prakashan's Indirect Taxes Laws [Pocket-IDT] 2022-23](https://law-all.com/image/cache/catalog/data/Book Images/Ajit Prakashan/2022/AP322-300x300.jpg)

![Ajit Prakashan's Let's Save Income Tax [Marathi - चला आयकर वाचवूया...] by Adv. Sudhir J. Birje | Chala Aaykar Vachvuya Ajit Prakashan's Let's Save Income Tax [Marathi - चला आयकर वाचवूया...] by Adv. Sudhir J. Birje | Chala Aaykar Vachvuya](https://law-all.com/image/cache/catalog/data/Book Images/Ajit Prakashan/2023/AP348-300x300.jpg)

![Arun Godbole's Pagaratun Aaykarkapat Margdarshika 2019-20 [Marathi] by Kaushik Prakashan Arun Godbole's Pagaratun Aaykarkapat Margdarshika 2019-20 [Marathi] by Kaushik Prakashan](https://law-all.com/image/cache/catalog/data/Book Images/Kaushik Prakashan/2019/KAU001-300x300.jpg)

![Asia Law House's GST Rate Finder on Goods by Ghanshyam Upadhyay [Edition 2021] Asia Law House's GST Rate Finder on Goods by Ghanshyam Upadhyay [Edition 2021]](https://law-all.com/image/cache/catalog/data/Book Images/Asia Law House/2021/ALH05-300x300.jpg)

![Asia Law House's Guide to Income Tax on Salaries by TVR Satya Prasad [A. Y. 2023-24 & 2024-25] Asia Law House's Guide to Income Tax on Salaries by TVR Satya Prasad [A. Y. 2023-24 & 2024-25]](https://law-all.com/image/cache/catalog/data/Book Images/Asia Law House/2023/9789386730312-300x300.jpg)

![BDP's Customs & Central Excise Notifications [under GST Regime w.e.f. 1st July 2017] BDP's Customs & Central Excise Notifications [under GST Regime w.e.f. 1st July 2017]](https://law-all.com/image/cache/catalog/data/Book Images/Business Datainfo Pub/2017/9788178521084-300x300.jpg)

![BDP's GST Tariff by Dr. Somesh Chander & Anand Garg [2018-19] BDP's GST Tariff by Dr. Somesh Chander & Anand Garg [2018-19]](https://law-all.com/image/cache/catalog/data/Book Images/Business Datainfo Pub/2018/9788178521152-300x300.jpg)

![BDP's ITC-HS Classifications on Import Items with Indian Import Tariff by Anand Garg [2 Vols. Edn. 2023] BDP's ITC-HS Classifications on Import Items with Indian Import Tariff by Anand Garg [2 Vols. Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Business Datainfo Pub/2022/9788178521176-300x300.jpg)

![BDP's Standard Input-Output Norms [Vol.2] by Anand Garg BDP's Standard Input-Output Norms [Vol.2] by Anand Garg](https://law-all.com/image/cache/catalog/data/Book Images/Business Datainfo Pub/2017/9788178521138-300x300.jpg)

![Bharat ABC of GST by Anil Goyal, Pranjal Goyal & Vaishali Goyal [Edn. 2023] Bharat ABC of GST by Anil Goyal, Pranjal Goyal & Vaishali Goyal [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789394163706-300x300.jpg)

![Bharat Law House's Minimum Alternate Tax (MAT) by CA. Kamal Garg [Edn. 2023] Bharat Law House's Minimum Alternate Tax (MAT) by CA. Kamal Garg [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9788196260552-300x300.jpg)

![Bharat Law Publication's Tax Planning Issues Ideas Innovations [HB] by S. Rajaratnam & V. G. Arvindanayagi [2021 Edn.] Bharat Law Publication's Tax Planning Issues Ideas Innovations [HB] by S. Rajaratnam & V. G. Arvindanayagi [2021 Edn.]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law Pub/2021/9788173460753-300x300.jpeg)

![Bharat's Direct Taxes Manual 2023 [DT 3 HB Volumes] Bharat's Direct Taxes Manual 2023 [DT 3 HB Volumes]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9788193260514-300x300.jpg)

![Bharat's GST Case Digest by Rajat Mohan [Edn. 2024] | Taxsutra | Goods & Services Tax Bharat's GST Case Digest by Rajat Mohan [Edn. 2024] | Taxsutra | Goods & Services Tax](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2024/9788196617134-300x300.JPG)

![Bharat's GST Law & Procedures by CA. Ashok Batra [3 Vols. 2023] Bharat's GST Law & Procedures by CA. Ashok Batra [3 Vols. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789394163478-300x300.jpg)

![Bharat's Guide to GST Litigation & Proceedings [HB] by Preetam Singh Bharat's Guide to GST Litigation & Proceedings [HB] by Preetam Singh](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2019/9789386920232-300x300.jpg)

![Bharat's Guide to Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 [SVLDRS] by CA. Pritam Mahure Bharat's Guide to Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 [SVLDRS] by CA. Pritam Mahure](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2019/9789386920157-300x300.jpg)

![Bharat's Handbook on GST (Goods & Service Tax) for CA / CS / CMA / BBA / Bcom / Mcom Inter May 2024 Exam [New Syllabus] by Raj K. Agrawal Bharat's Handbook on GST (Goods & Service Tax) for CA / CS / CMA / BBA / Bcom / Mcom Inter May 2024 Exam [New Syllabus] by Raj K. Agrawal](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9788119565511-300x300.jpg)

![Bharat's Hindu Undivided Family [HUF] Formation, Management & Taxation by CA. Pawan K. Jain [Edn. 2023] Bharat's Hindu Undivided Family [HUF] Formation, Management & Taxation by CA. Pawan K. Jain [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9788196260569-300x300.jpg)

![Bharat's Income Computation & Disclosure Standards [ICDS] by CA. Kamal Garg [Edn. 2023] Bharat's Income Computation & Disclosure Standards [ICDS] by CA. Kamal Garg [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9788196260576-300x300.jpg)

![Bharat's Income Tax Rules with Return Forms 2023 [Free E-Book Access] Bharat's Income Tax Rules with Return Forms 2023 [Free E-Book Access]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789393749864-300x300.jpg)

![Bharat's Taxation Regime for ONLINE GAMING by by CA. R. S. Kalra [Edn. 2023] Bharat's Taxation Regime for ONLINE GAMING by by CA. R. S. Kalra [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789394163713-300x300.jpg)

![Bharat's Treatise on Schedule III (A guide for preparation of Financial Statements F. Y. 2022-23) by CA. (Dr.) Alok K. Garg [Edn. 2023] Bharat's Treatise on Schedule III (A guide for preparation of Financial Statements F. Y. 2022-23) by CA. (Dr.) Alok K. Garg [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789394163690-300x300.jpg)

![Bharat's Treatise on Tax Deduction / Collection At Source Including Advanced Tax & Refund [TDS & TCS -HB] by T. N. Pandey & CA. Kamal Garg Bharat's Treatise on Tax Deduction / Collection At Source Including Advanced Tax & Refund [TDS & TCS -HB] by T. N. Pandey & CA. Kamal Garg](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2017/9789351394839-300x300.jpg)

![Bharat’s All About Trusts & NGOs by CA. Chunauti H. Dholakia [Edn. 2023] Bharat’s All About Trusts & NGOs by CA. Chunauti H. Dholakia [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789394163485-300x300.jpg)

![Bharat’s GST Tracker by CA. Kashish Gupta [2 PB. Volumes] Bharat’s GST Tracker by CA. Kashish Gupta [2 PB. Volumes]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2021/9789390854547-300x300.jpg)

![Bharat’s Handbook on Tax Deduction At Source [TDS] Including Tax Collection At Source [TCS] 2023 by CA. P.T. Joy Bharat’s Handbook on Tax Deduction At Source [TDS] Including Tax Collection At Source [TCS] 2023 by CA. P.T. Joy](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9788196260583-300x300.jpg)

![Bharat’s Interest, Fee & Penalty by R. P. Garg [Edn. 2023] Bharat’s Interest, Fee & Penalty by R. P. Garg [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789394163621-300x300.jpg)

![Bharat’s One Stop Referencer for Assessments & Appeals by Amit Kumar Gupta, Davinder Singh [Edn. 2023] Bharat’s One Stop Referencer for Assessments & Appeals by Amit Kumar Gupta, Davinder Singh [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789394163683-300x300.jpg)

![Bharat’s Practical Approach to TDS TCS by CA. R. S. Kalra [Edn. 2023] Bharat’s Practical Approach to TDS TCS by CA. R. S. Kalra [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9789394163638-300x300.jpg)

![Bharat’s Reverse Charge Mechanism under GST (RCM) by CA. Satbir Singh [Edn. 2023] Bharat’s Reverse Charge Mechanism under GST (RCM) by CA. Satbir Singh [Edn. 2023]](https://law-all.com/image/cache/catalog/data/Book Images/Bharat Law House/2023/9788194163645-300x300.jpg)