Contents:

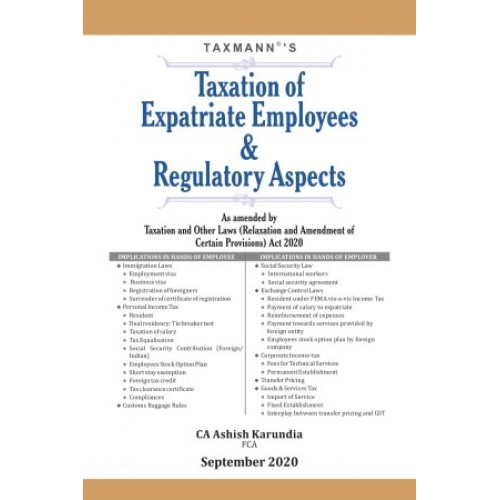

This book is a comprehensive guide to understand the taxation and regulatory aspect of the cross-border movement of employees, that results in secondment arrangements as amended by Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act 2020. As with any cross-border arrangement, multiple complex laws are involved, this book serves as a primer to understand these complexities and related compliances.

The discussion in this book starts with determining who is the employer of the expatriate, which is important to identify the correct laws to be complied with. This book aims at providing the reader, an insight into implications that typically arise in secondment arrangement(s), under various Indian laws in the hands of the expatriate & company, such as:

· Expatriate

o Immigration Laws

o Personal Income Tax

o Custom Baggage Rules

· Company

o Social Security Laws

o Exchange Control Laws

o Corporate Income Tax

o Transfer Pricing

o Goods & Services Tax

o Corporate Law

The Present Publication is the First Edition & Updated till 20th September 2020, authored by Ashish Karundia, with the following noteworthy features:

· Explains situs of accrual of salary, i.e. place of enforcement of employment contract or place of the rendering of services

· [Social Security Deduction] Discusses taxability as well as deductibility of contribution to overseas social security contribution in the hands of the employee

· [Salary] Captures detailed analysis of disputed salary ingredients such as

o Per-Diem/Per-Day Allowance

o Tax Equalization

o Hypothetical Tax

o Employee Stock Option Plan(s)

· [Short Stay] Explains the conditions for short stay exemption and related issues

· [Visa] Points out the difference between employment visa and business visa

· Explains various clauses such as detachment, exportability and totalization of social security agreements

· [Meaning of Resident] Lucidly explains the difference between ‘resident’ as per income-tax and ‘resident’ as per FEMA

· Explains whether secondment agreement will qualify as deemed international transaction or not

· Explains situations when fixed establishment (GST) of the foreign entity is triggered

Taxmann's Taxation of Expatriate Employees & Regulatory Aspects by Ashish Karundia

- Publisher: Taxmann Publications

- Book Code: 9789390128617

- Availability: 10

-

Rs1,150.00